Stellar: The Choice of a New Generation

Last week we “nerded out” over Stellar, a new financial protocol that we think has the potential to change the fabric of the global financial system.

Hence, the Prospress SF team (i.e. Brent and I) were excited to be able to attend the first ever Stellar Developer Meetup, at the Stripe offices in San Francisco.

If you’ll permit us some further nerding out, keep on reading.

Patrick Collison, Cofounder and CEO of Stripe, explaining the current “suckage” of international payments, comparing it to email before SMTP.

What’s Happened in the First 14 Days?

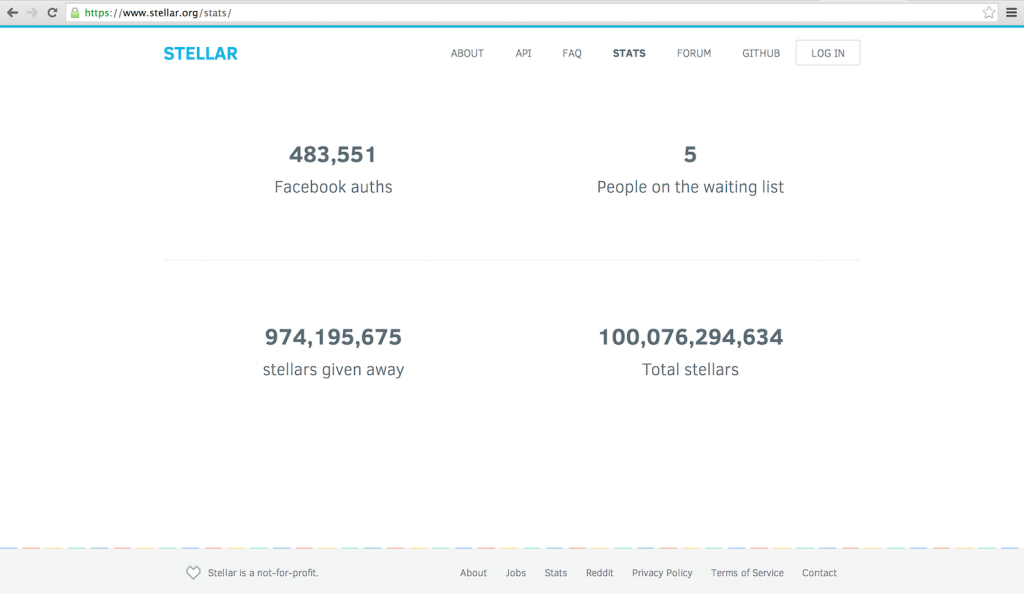

Things have moved quickly since Stellar was first announced (now two weeks ago). Joyce Kim, the Executive Director at Stellar, gave a summary of the things that have happened since Stellar, whose goal is to provide open source financial access to the world, was launched (this was at the 12 day mark):

- 32% of users in the forum were new to cryptocurrencies.

- The top five languages on Stellar were: English at 56%; Vietnamese at 15%; Indonesian at 5%; Spanish at 5%; and Chinese (sorry I didn’t catch the percentage for Chinese, but it must be 5% or less).

- There had been 600,000 site visitors, and around half of those visitors had come back to the site.

- 870 million stellars had been distributed.

- Stellar had become the third largest cryptocurrency based on trading volume on JustCoin (it now looks to be No. 1).

Some pretty amazing observations from the above stats include that a third of users are new to cryptocurrencies (including us). That may indicate that Stellar has been more successful at tapping into mainstream audiences than previous cryptocurrencies. This is a good sign for their goal of providing open source financial access to everyone in the world.

Another cool observation is that the second highest percentage of users is Vietnamese. As someone who spent almost a year living in Hanoi, I can see why that would be. Joyce noted that a popular blogger picked up on Stellar and blogged about it straight away, which helped spur its adoption. But Vietnam has had pretty atrocious levels of inflation in recent years (according to the World Bank it was between 10.9% and 21.3% between 2010 and 2012. Central banks typically target inflation of 2-3%).

Joyce also listed some of the things that had been built around Stellar in the first 12 days:

- A live stream of transactions and Stellar Explorer.

- A Stellar Java API.

- InflationDest, “a quick and dirty tool that allows you to view the InflationDest of any account, and to set the InflationDest of accounts you own.”

- 1 click gateway setup.

- Stellar Value, which provides live prices and statistics.

- Justcoin connected 12 hours after launch.

- Stellar Jackpot, a stellar lottery.

- And a community forum, reflecting the fact that Stellar.org is trying to democratise as much as possible.

Millennial Disruption Index

As we looked around the room we saw mostly millennials (and—disappointingly but not surprisingly—mostly dudes).

This made us think of a recent digital report we’d seen: The Millennial Disruption Index from Scratch. (Check it out, it’s really well done).

Scratch conducted a three year study of America’s 84 million millennials (people born between 1981 and 2000) in the US. The study, of “the largest generation in American history,” was based on 200+ interviews and over 10,000 respondents.

Scratch concluded from their study that banking is the industry at the highest risk of disruption.

Some of the most startling facts include:

- 53% don’t think their banks offer anything different from other banks.

- 68% say that in five years, the way we access our money will be totally different.

- 70% say that in five years, the way we pay for things will be totally different.

- 33% believe they won’t need a bank at all.

- Almost 50% are counting on tech startups to overhaul the way banks work.

- And 73% would be more excited about a new offering in financial services from Google, Amazon, Apple, PayPal, Square than from their own bank.

If representative, those responses indicate that the millennial generation (at least in the US, although the early Stellar statistics indicate it’s a broader global trend) is ready and excited for a financial system that looks significantly different from what their parents are used to. Something that looks more like modern email and less like the postal system.

They are also ready to accept that system from technology companies, rather than from traditional banks. In fact, around half of them are counting on tech companies to overhaul how banks work.

All of which might help explain why the reaction to, and adoption of, Stellar has far outgrown initial expectations (Stellar.org were expecting 10,000 signups in the first month, and instead got almost 500,000 sign ups in the first two weeks).

It seems we’re not the only millennials nerding out over Stellar.

Thanks for your post, I dun know about Stellar until read your post. And so surprise to learn that Vietnam is the 2nd of the list 🙂

You’re welcome Ngan! We’re happy to have a new reader from Vietnam 🙂

If i’m not wrong stellarchain.io is offering Live transactions, explorer and value, i don’t see the point of the other sites.

StellarChain only serves one purpose – realtime transaction reporting. It doesn’t report history, like CryptoCoin Charts and doesn’t do any sort of analysis on the ledger, like Yett (which we only found after publishing this post), which reports daily volume and the 100 accounts holding the most Stellar.

[…] has now received over one million Facebook authorisations. Last time we wrote about Stellar, they had received over 500,000 […]

[…] This supports our previous position, that Millennials are ready and excited for a new payments paradigm. […]